RI Advice Monthly Market Update – September 2021

- Mat Faint

- Sep 28, 2021

- 2 min read

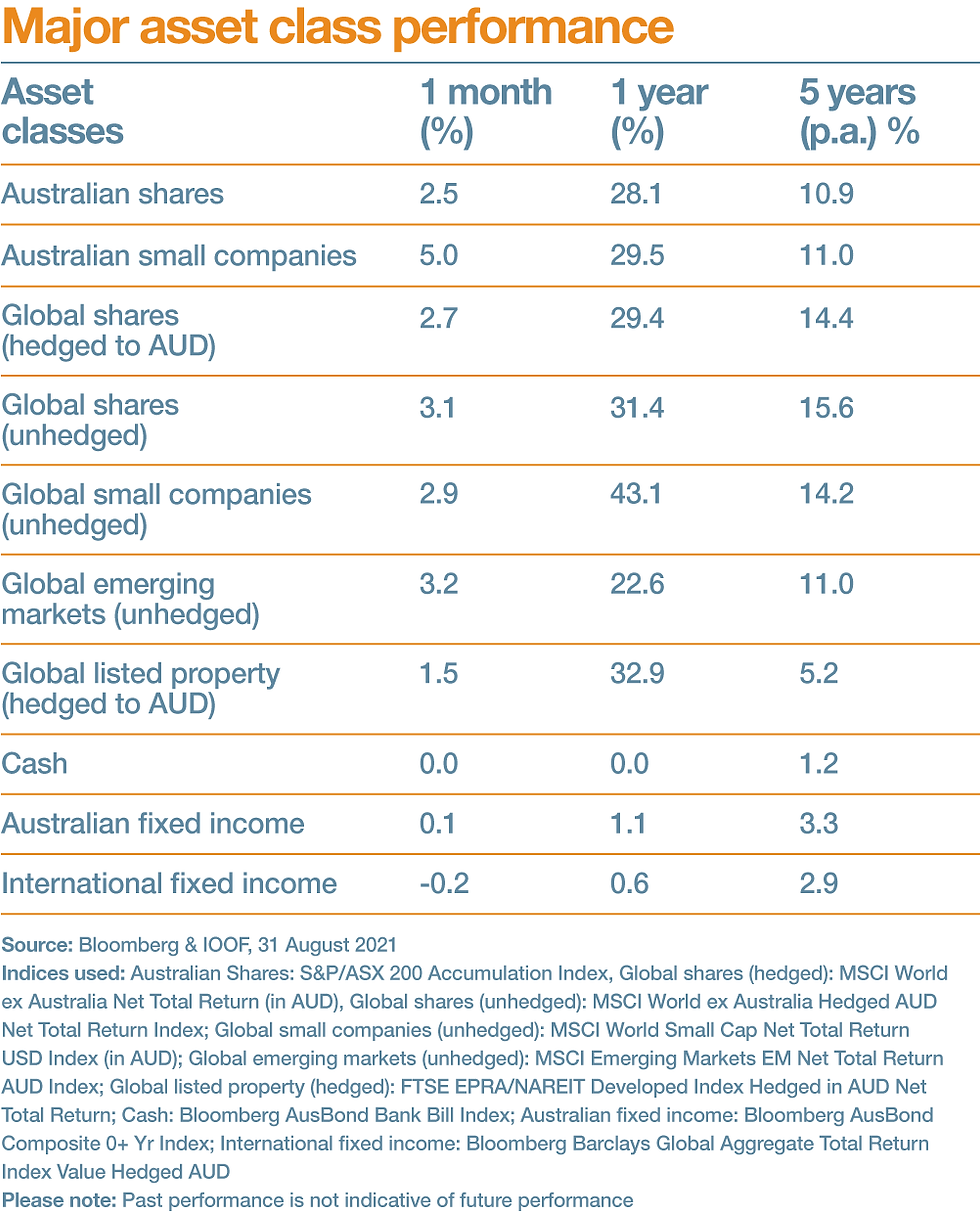

Global shares rose 2.7% and 3.1% in hedged and unhedged terms, respectively. The market was led higher by US tech stocks as investors anticipated a slower economic growth environment in which more cyclical names will struggle.

Australian shares underperformed global shares, rising 2.5% in August. The leading sectors were technology (up 16.8%) buoyed by a takeover bid for Afterpay from US payments giant Square and healthcare (up 6.8%). Materials was the worst performer (down 7.9%) driven by lower iron ore prices and forced selling of BHP following news that it is ending its UK dual listing.

The Australian dollar (AUD) fell 0.6% against major currencies and 0.4% against the US dollar. Lockdowns in both NSW and Victoria dragged on the economy souring investor support.

Fixed income returns were mixed. The decline in bond yields supported Australian bond returns. Arguably we saw some resolution of the bond vs equity world views with global yields rising and equities continuing to perform well. Weighing against this however is the relative weakness of cyclical stocks.

Globally

Global business surveys suggest economic growth momentum has peaked with a slowdown exacerbated by the Delta strain and related supply chain disruption notably in the Asia-Pacific region.

The US followed Israel in approving booster doses bolstering confidence that future mutant strains will be contained.

Locally

Economic growth for the June quarter surprised on the upside with strong household and government spending offsetting export weakness (production issues and high commodity prices).

High commodity prices can cause exports to be a net drag if lower volumes are exported relative to previous periods. This is because we focus on real GDP, an underlying measure of economic growth.

The Sydney lockdown was extended until the end of September. Peak daily cases may be reached in September according to government modelling.

Pleasingly vaccine progress is tracking strongly, boosting confidence that re-opening will occur in the December quarter this year. This can be seen in both consumer and business surveys which are considerably more positive than they were during the pandemic’s first wave last year.

The RBA left its cash rate unchanged and deferred a reduction in its bond purchases until early next year.

RI Advice Sutherland

Suite 5 level 5/3-5 Stapleton Ave, Sutherland NSW 2232

The information above, including tax, does not consider your personal circumstances and is general advice only. It has been prepared without taking into account any of your individual objectives, financial solutions or needs.

Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser.

RI Advice Group Pty Limited ABN 23 001 774 125, AFSL 238429.

Comments